Medium-term Management Plan

Mid-Term Plan Theme

『Transformation』 & 『Growth』

~ Continuous Evolution with Founding Spirit ~

~ “Your Smile, Our Value” ~

Key Strategic:『Transformation』

- Inorganic Growth investment

- IT & Digital Infrastructure Enhancement

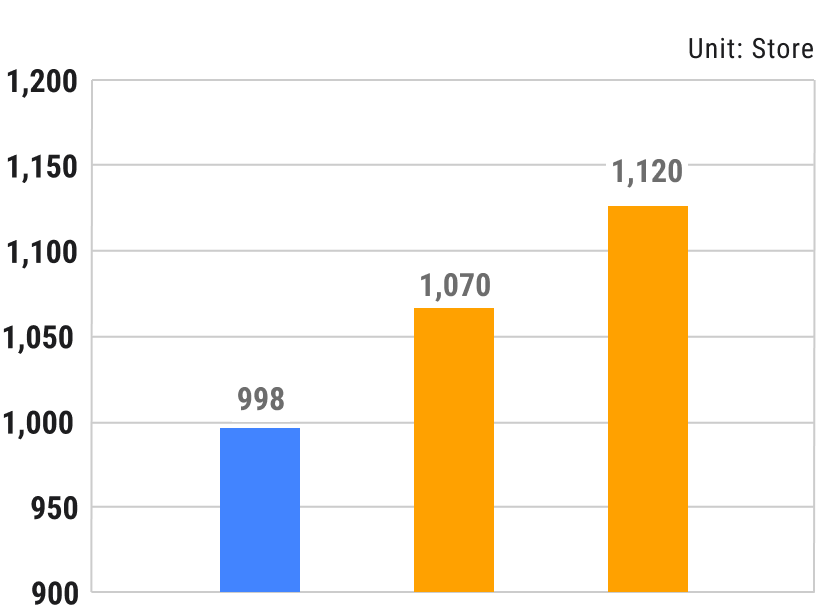

- Store Network Expansion

- Seamless Management between corporate and Brands

2025-2029 Strategic Roadmap

-

- Profitability Restoration

- Portfolio Optimization

- Break Even Optimization

- Crisis Driven Financing

Revenue 153.6 Operation

Profit2.3 -

- Profitability Enhancement

- C&C Model Renovation Yoshinoya

- Hanamaru Recovery

- Ramen M&A Expansion

- Financial Base Reinforcement

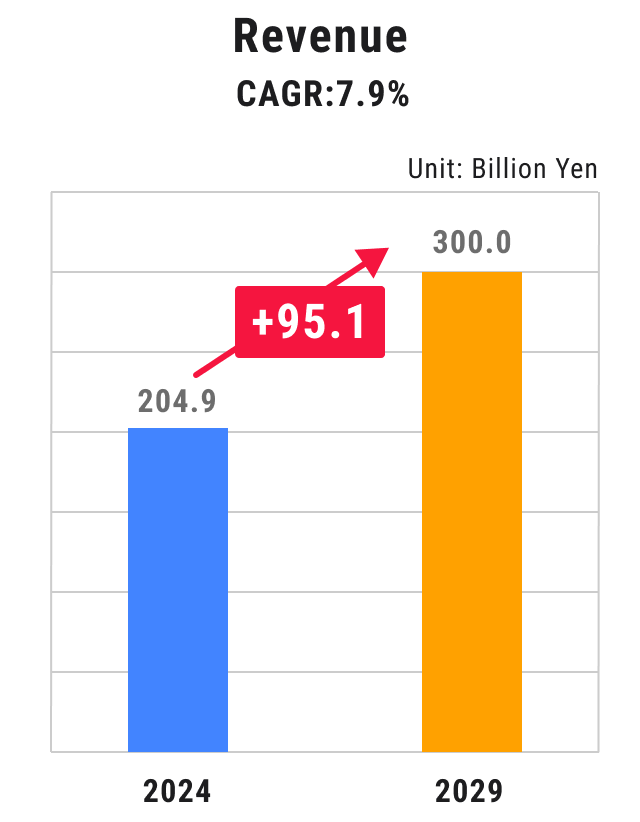

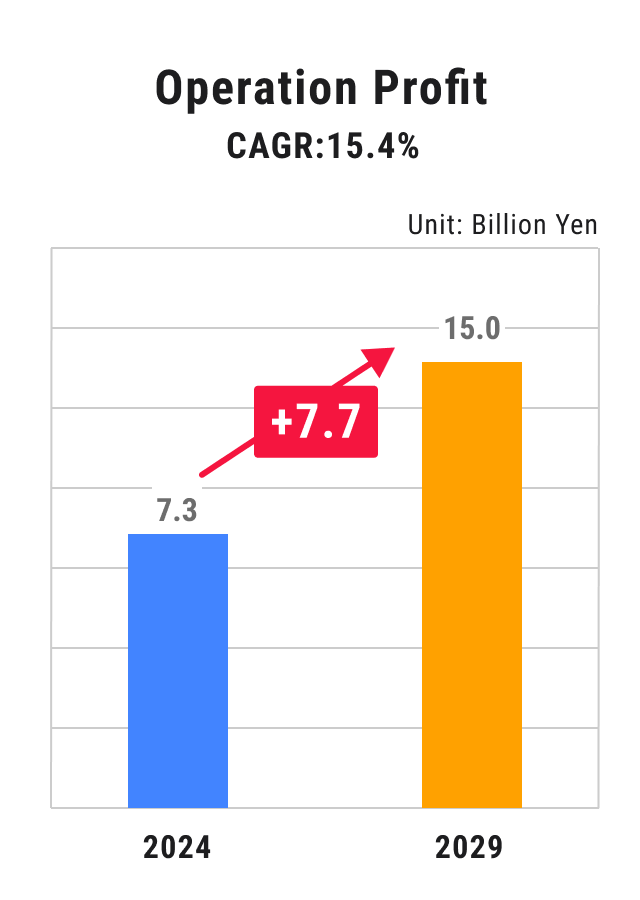

Revenue 204.9 Operation

Profit7.3 -

- Profitability Maximization

- Growth Investment

- Ramen Business Acceleration

- Business Portfolio Expansion

- Digital Investment Acceleration

Revenue 300.0 Operation

Profit15.0

2025-2029 Core Elements of the Mid-Term Plan

Mid-Term Plan ~『Transformation』 & 『Growth』~

- Strategy Direction

- “The Transformation of Existing Businesses” & “The Growth of New Business Drivers”

- Financial Target

- FY2029: ROIC 7.0% D/E Ratio 0.9x

- 3 Strategic Pillars

-

-

Strengthen

- Domestic

- Business Model Evolution & Creation of New Value

-

Accelerate

- Ramen

- Establishing Another Core Business Segment

-

Expand

- Overseas

- Optimizing Existing Areas & Entering New Markets

-

- Key Strategic Areas for Execution

-

- Inorganic Investment

- Human Capital Development

- IT Investment & Infrastructure Enhancement

- Sustainability Initiatives Enhancement

- Group Function Synchronization

- Social Value

Enhancement - Economic Value

Enhancement

2029 Performance Indicators

| Enhancing Profitability |

|

|---|---|

| Improving Capital Efficiency | ROIC 7.0% |

| Maintaining Financial Stability | D/E Ratio ≤ 0.9x |

| Establishing New Growth Drivers | Ramen Revenue 40.0 billion yen |

Business Strategy Overview

Yoshinoya

| Revitalize |

|

|---|---|

| Expand |

|

| Challenge |

|

Detailed Initiatives

New Service Model Stores

Fried Chicken Product Line

Newly Developed Brands

-

Karubi no Toriko - Specialty brand for 『Beef Kalbi Rice Bowl』『Korean-style Tofu Stew』

-

Deikara - Specialty brand for 『Crispy Fried Chicken』『Handmade Rice Balls (Onigiri)』

-

Moo~Toriko - Specialty brand for 『Beef Curry』

Packaged Product Sales

14,000 Store Distribution by 2029 (150% vs. 2025)

-

Shelf Stable Market Expansion

Customer Segment Expansion Beyond Frozen

-

Group Brand Commercialization

Brand Value Enhancement via EC

Customer Touchpoint Expansion via Supermarkets

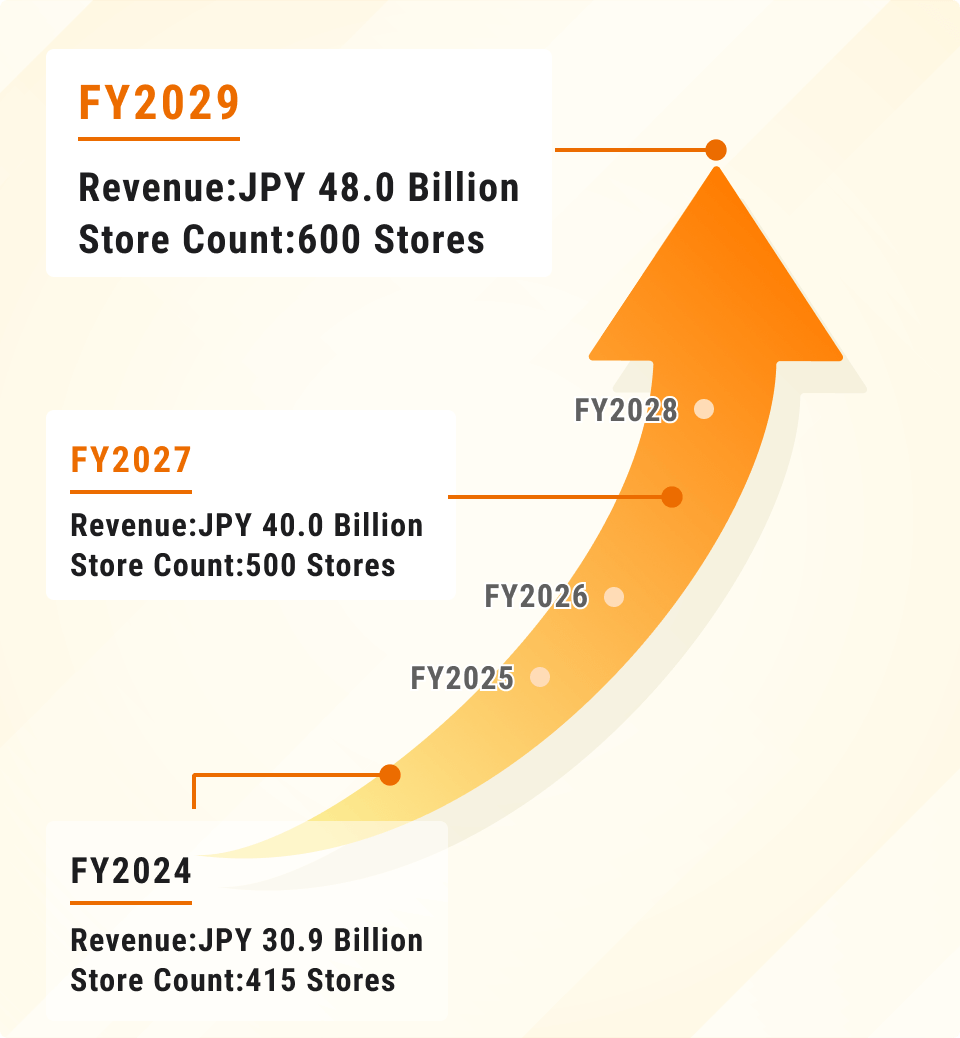

Hanamaru

Transformation & Growth Initiatives

| Revitalize |

|

|---|---|

| Expand |

|

| Challenge |

|

New Value in Existing Business

- Location Based Sales Strategy

・Suburban Area...Relaxed Comfort → Sophisticated Renovations Made-to-Order Satisfaction

・Office District...Everyday Vibes → Value Focused Menu

・Food Court...Menu Optimization - Data Driven Product Development & Promotion

Store Expansion Strategy

- Top 3 Urban Markets Expansion

- Kishimen Concept: ZZZ Brand Expansion from Hoshigaoka Noodle Factory

- Western Style Izakaya Expansion

- Japanese Noodle Fusion

Strengthen Growth Foundation

- Hiring Channels Diversification: Overseas Japanese School Partnerships, High School Graduate Hiring Reinforcement, Senior Talent Utilization

- System Development: Overseas Training Center Launch, Udon School, Kids’ Cafeteria Activities

Overseas

Expansion Initiatives

Key Overseas Strategies

- Product: Japanese Items, Localization

- Pricing: Regional Pricing, Competitive Edge

- Sales: Store Model Customization

- Promotion: Area Specific SNS Usage

- Franchise: Local Partner Collaboration

Mid-Term Initiatives

| Revitalize |

|

|---|---|

| Expand |

|

| Challenge |

|

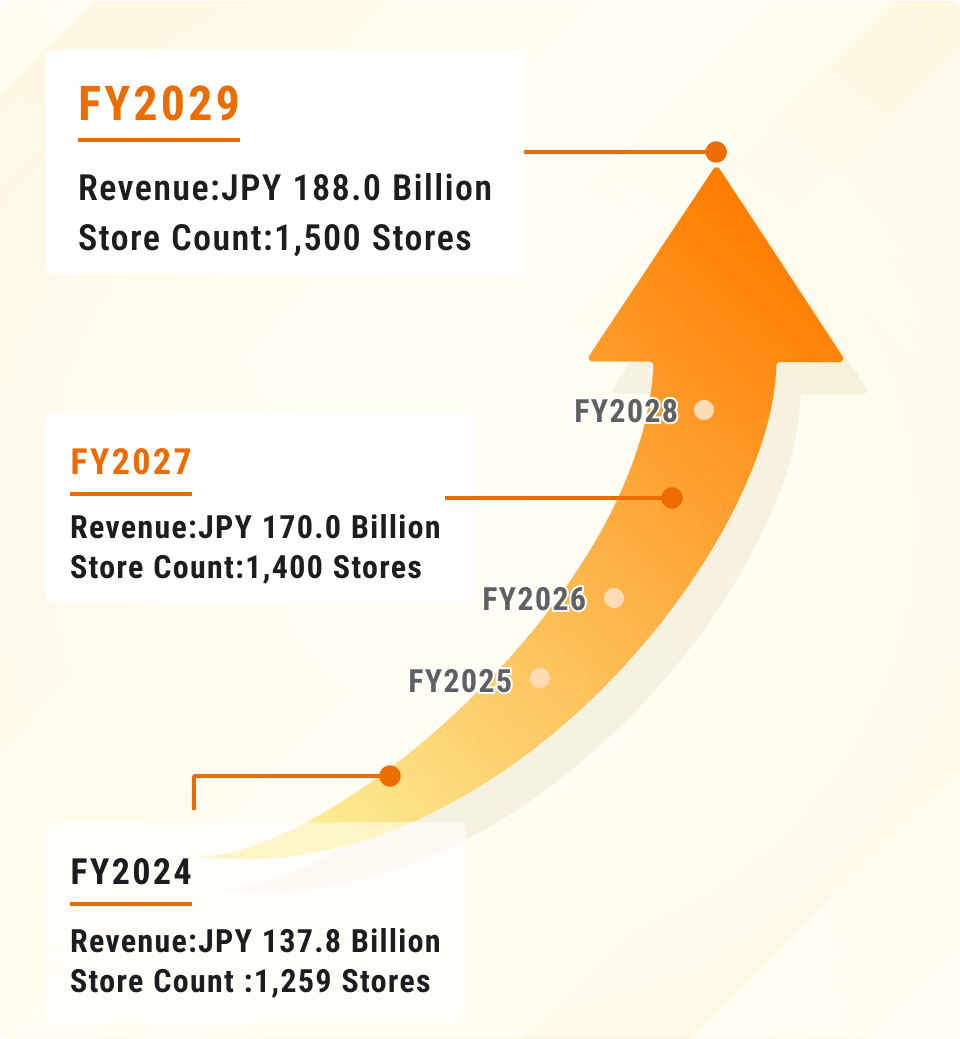

Overseas (Yoshinoya)

-

Revenue

Apply proven domestic formats abroad to create successful international models

-

Store Count

Actively open stores in promising areas such as Mainland China and Southeast Asia

Ramen

Ramen Business Strategy: Targeting Global No.1 in Ramen Dining

- Ramen as the Third Business Pillar

- Brand Expansion & Strategic M&A Execution

- Global Demand Capture via In House Manufacturing & R&D (Takara Sangyo)

| FY2024 | FY2025 - FY2029 | FY2034 |

|---|---|---|

| Ramen Dining |

|

FY2029 Global No.1 in Ramen Dining |

| Manufacturing |

|

|

| Inorganic Growth |

|

| Revitalize |

|

|---|---|

| Expand |

|

| Challenge |

|

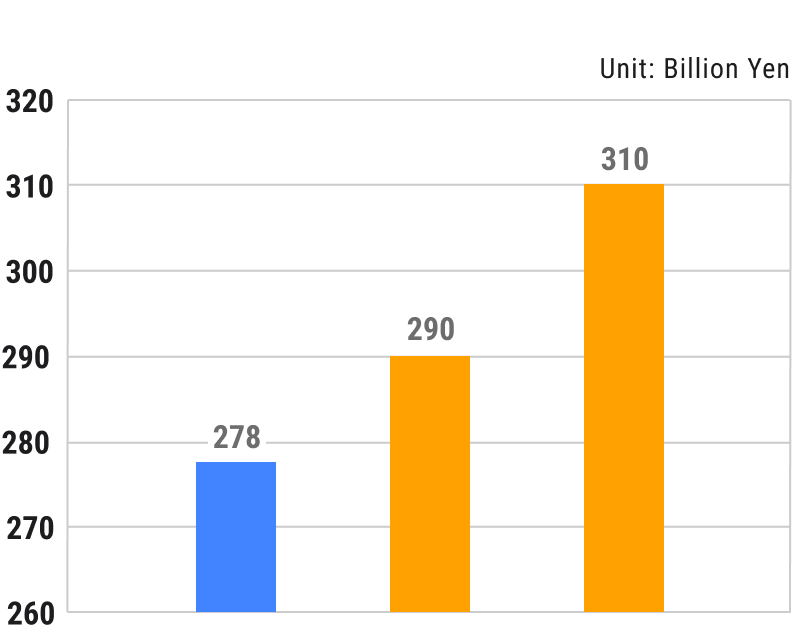

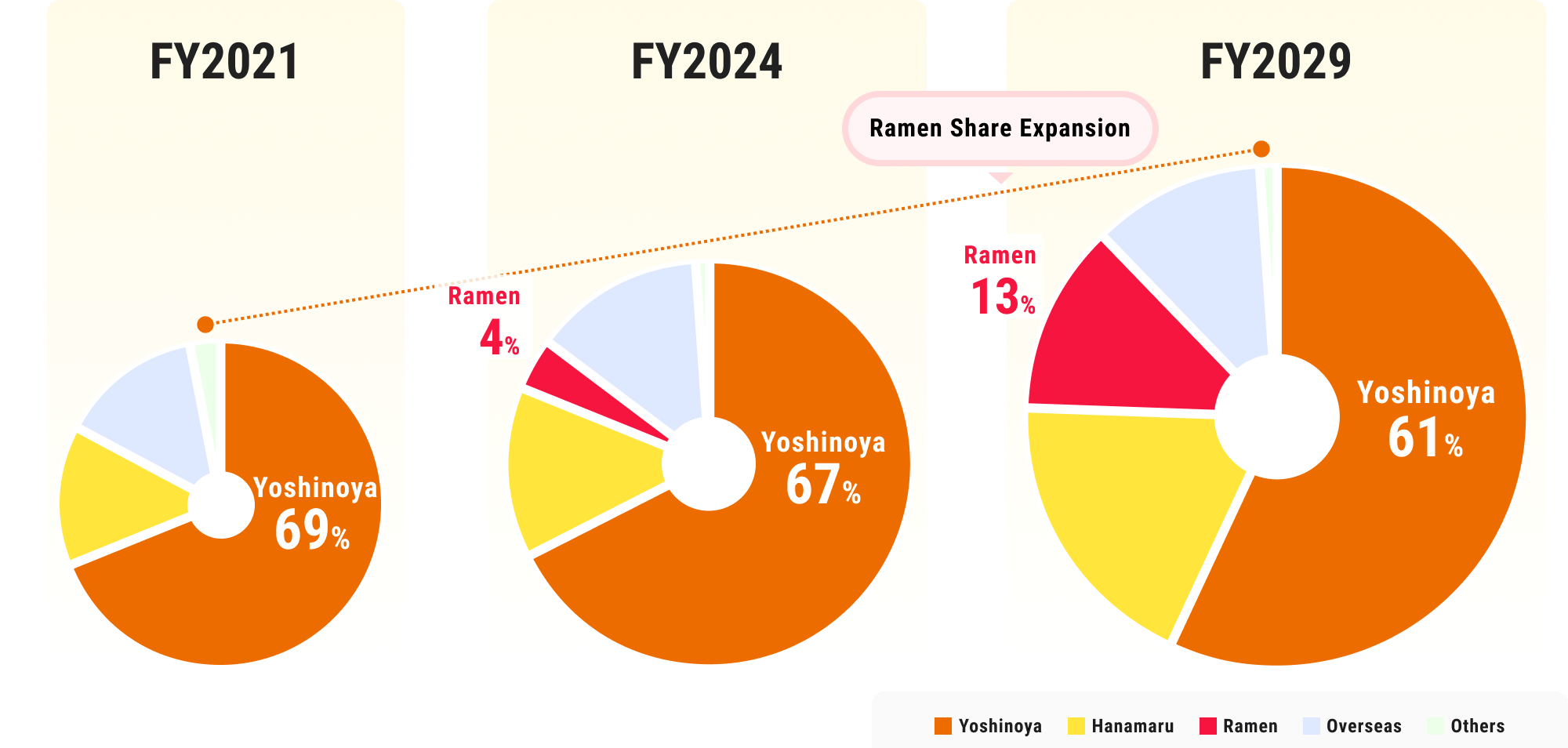

Business Portfolio Transition

Segment Base Sales Contribution Breakdown

Segment-Based Target

| Segment | FY2024 Performance (billion yen) |

FY2027 Target (billion yen) |

FY2029 Target (billion yen) |

CAGR (%) |

|---|---|---|---|---|

| Yoshinoya | 137.8 | 170.0 | 188.0 | 6.4 |

| Hanamaru | 30.9 | 40.0 | 48.0 | 9.2 |

| Overseas | 27.8 | 29.0 | 31.0 | 2.2 |

| Ramen | 8.0 | 17.0 | 40.0 | 38.0 |

| Segment | FY2024 Performance (billion yen) |

FY2027 Target (billion yen) |

FY2029 Target (billion yen) |

CAGR (%) |

|---|---|---|---|---|

| Yoshinoya | 7.8 | 10.0 | 12.1 | 9.2 |

| Hanamaru | 2.0 | 3.0 | 4.2 | 16.0 |

| Overseas | 1.2 | 1.7 | 2.5 | 15.8 |

| Ramen | 0.4 | 1.3 | 4.0 | 58.5 |

| Adjustment | △4.1 | △6.0 | △7.8 | - |

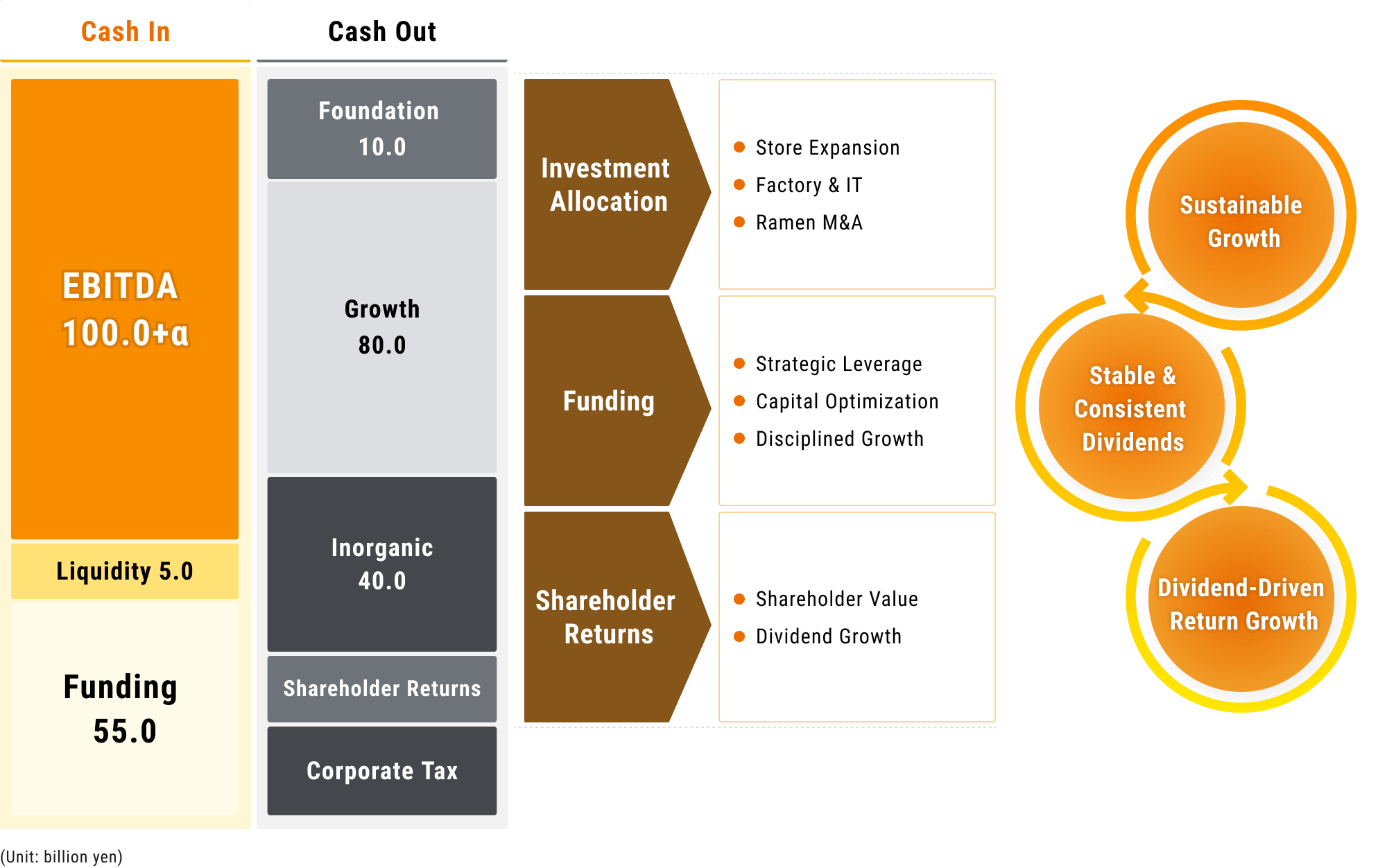

Financial Strategy

CAPEX Policy & Plan

Enhance corporate value by maintain financial discipline and improve investment efficiency, while investing in brand evolution and expanding the business portfolio through proactive inorganic growth.

| CAPEX Categories | 5-Year Investment (billion yen) |

Key Investment Areas |

|---|---|---|

| Existing Business Foundation |

5.0 |

|

| 5.0 |

|

|

| Existing Business Growth |

45.0 |

|

| 20.0 |

|

|

| 5.0 |

|

|

| 10.0 |

|

|

| Inorganic | 40.0 |

|

| 5-Year Investment Plan | 130.0 |

Cash Allocation Strategy

~Turning Cash Into Growth and Shareholder Value~

ROIC Improvement Initiatives

Maximizing Capital Efficiency through Stable Cash Generation

- Strengthening Cash Generation from Core Businesses

- Optimizing Capital Allocation to Improve ROIC

- FY2029 Target ROIC 7.0%

ROIC Improvement

ROIC (Return on Invested Capital) > WACC

-

Revenue Expansion via Strategic Investments

- Growth Investment

- QHA Driven Marketing Strategy

- HQ Cost Structure Optimization

- PDCA Acceleration for ROI Optimization

-

Capital Efficiency Improvement

- Debt Equity Balance Management

- Liquidity Cycle Optimization

- Shareholder Return Enhancement

Group-Wide Management Approach

- Horizontal Best Practice Integration

- Profitability Risk Response Framework

- Group-Level Optimization Over Silo Thinking

- ROI-Based M&A and Post Merger Integration

Human Capital Management Initiatives

Human Capital Management - Building a Workplace for Lifelong Commitment

Building Pride in Belonging for Employees and Their Families

-

Employee Loyalty Enhancement

Organizational Culture Reform: Developing Systems and Policies to Support Flexible and Diverse Workstyles

- Workplace Enhancement

- Engagement Survey Integration

- DE&I Program Implementation

- Employee Wellness Initiatives

-

Human Capital Resilience Reinforcement

Employer Branding Enhancement: Building Strategic Recruitment Systems to Secure Growth Oriented Talent

- Recruitment Media Optimization

- Diversified Recruitment Channels

- Compensation Optimization

- Hiring Process Optimization

-

Market Competitive Talent Development

Human Resource Data Utilization: Redesigning Group Wide Education and Career Path Systems to Continuously Develop Sustainable Leadership Talent

- HR System Modernization

- Talent Data Analytics

- Tiered Training Redesign

- Cross-Group Talent Mobility

- External Secondment Programs

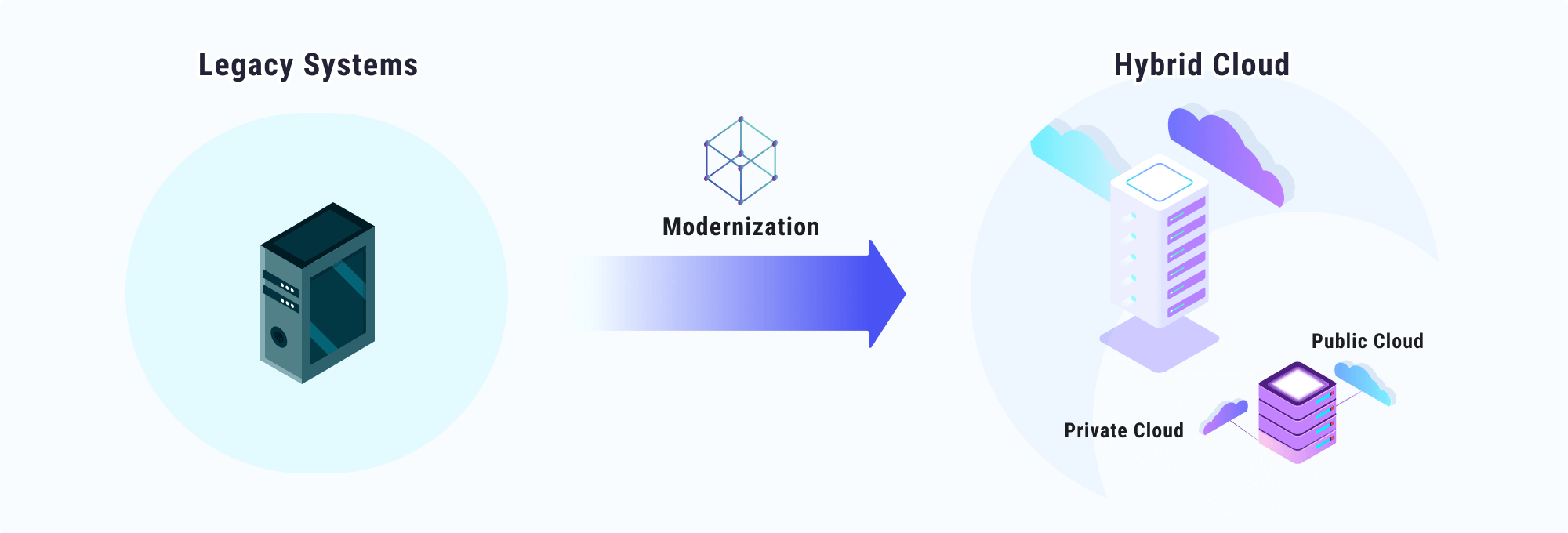

IT & Digital Strategy

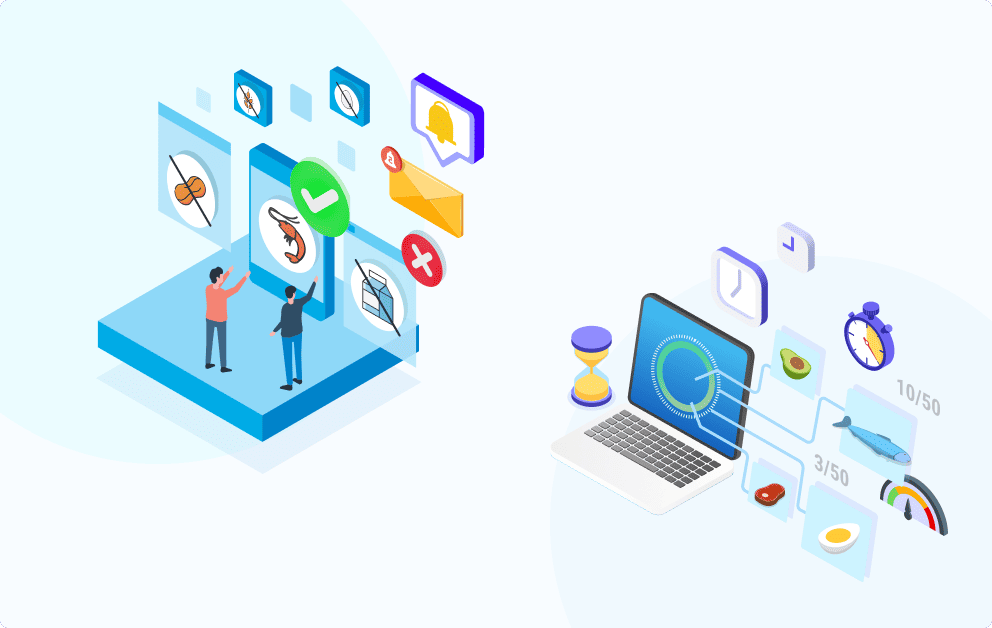

Data-Driven Transformation (¥15 Billion IT Strategy for Group Wide Innovation)

Enhancing Service, Quality, and Efficiency to Strengthen Group Competitiveness and Loyalty

System Modernization

UX Enhancement

Information Visibility

- Real Time Access to Critical Data

- Fast Information Delivery

(Stock Optimization / Waste Reduction)

EX Enhancement

Operational Automation

- Order & Forecast Automation

- SNS and AI Response Infrastructure

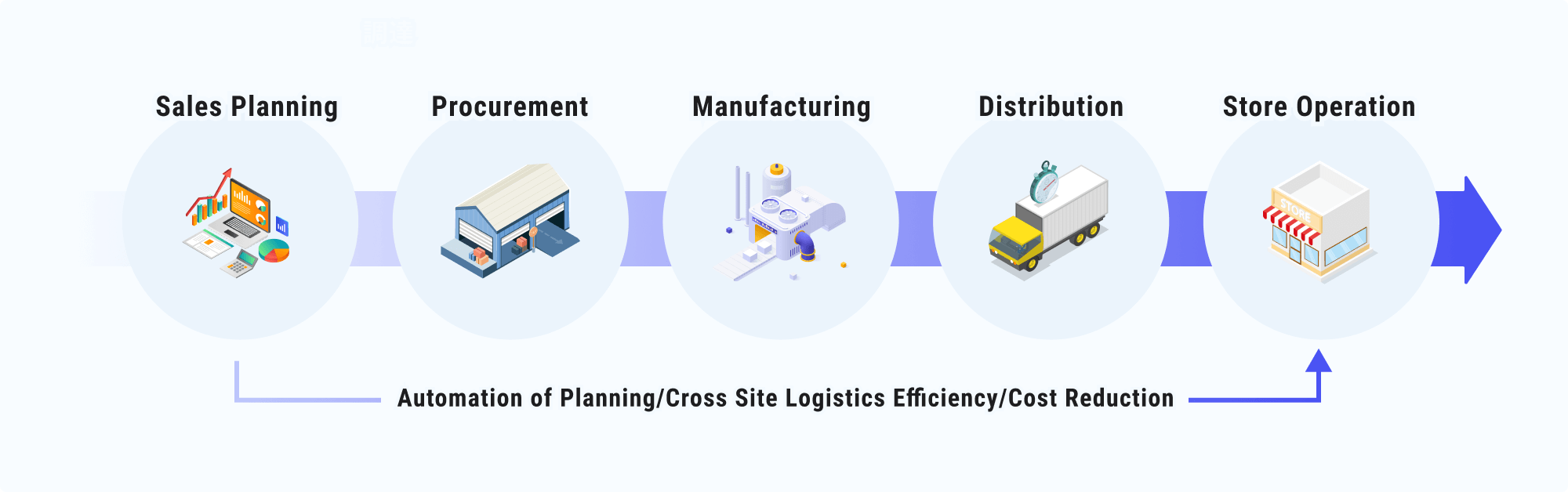

Supply Chain Optimization

Sustainability Initiatives

Sustainability Driven Competitive Advantage

- ESG Integration for Market Advantage

- Non-Financial Value Integration into Business Strategy

![Non Financial Value Integration into Business Strategy [Human Capital Diversity] [Food-Driven Wellness] [Community Empowerment] [Sustainable Supply Chains] [Climate Resilience] | ESG Integration [Talent Development] [Women’s Empowerment] [Employee Wellness] [Food Safety] [Functional Food] [Child Meal Program] [Disaster Response] [Supplier Monitoring] [Food Waste Reduction] [Waste Recycling] | Competitive Impact [Future-Oriented Operations] [Inclusive Branding] [Safety Assurance] [Universal Food Access] [Regional Revitalization] [Job Creation] [Sustainable Supply Chains] [Green Profitability]](/english/img/ir/management_plan_sustainability_promotion.png)