Approach and Structure for Corporate Governance

Fundamental policy on corporate governance

Understanding the importance of compliance and corporate ethics, Yoshinoya Holdings believes that it has a mission to consistently improve its enterprise value while boosting management efficiency, soundness, and transparency, to become a company that is trusted and respected by society.

In addition to its efforts to develop and maintain good relations with a range of stakeholders, including shareholders, customers, employees, business partners, and communities, the Company strives to increase management transparency, disclosing information actively and promptly to its shareholders and investors.

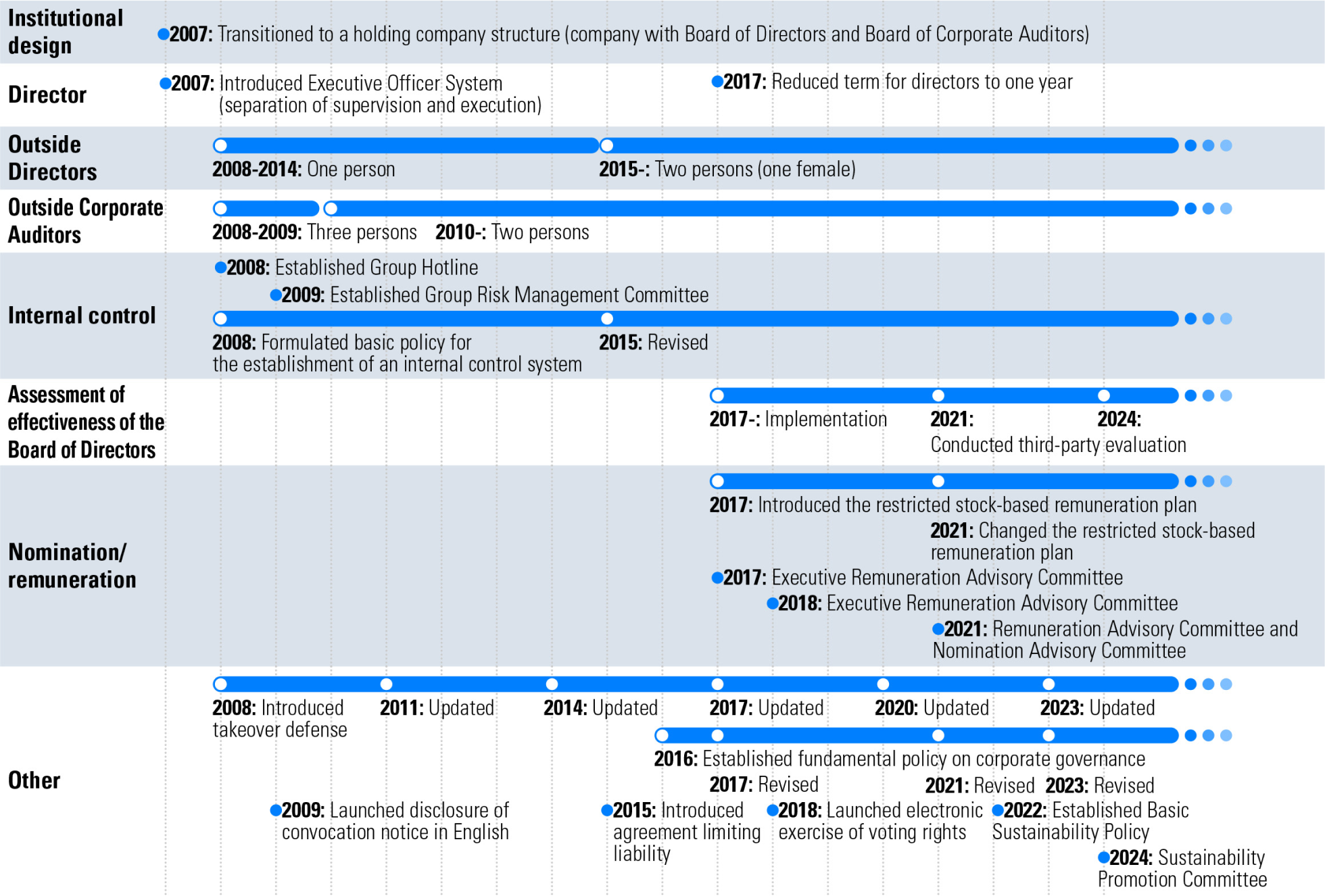

Efforts to Date to Strengthen Governance

Background and Characteristics of Governance Structure

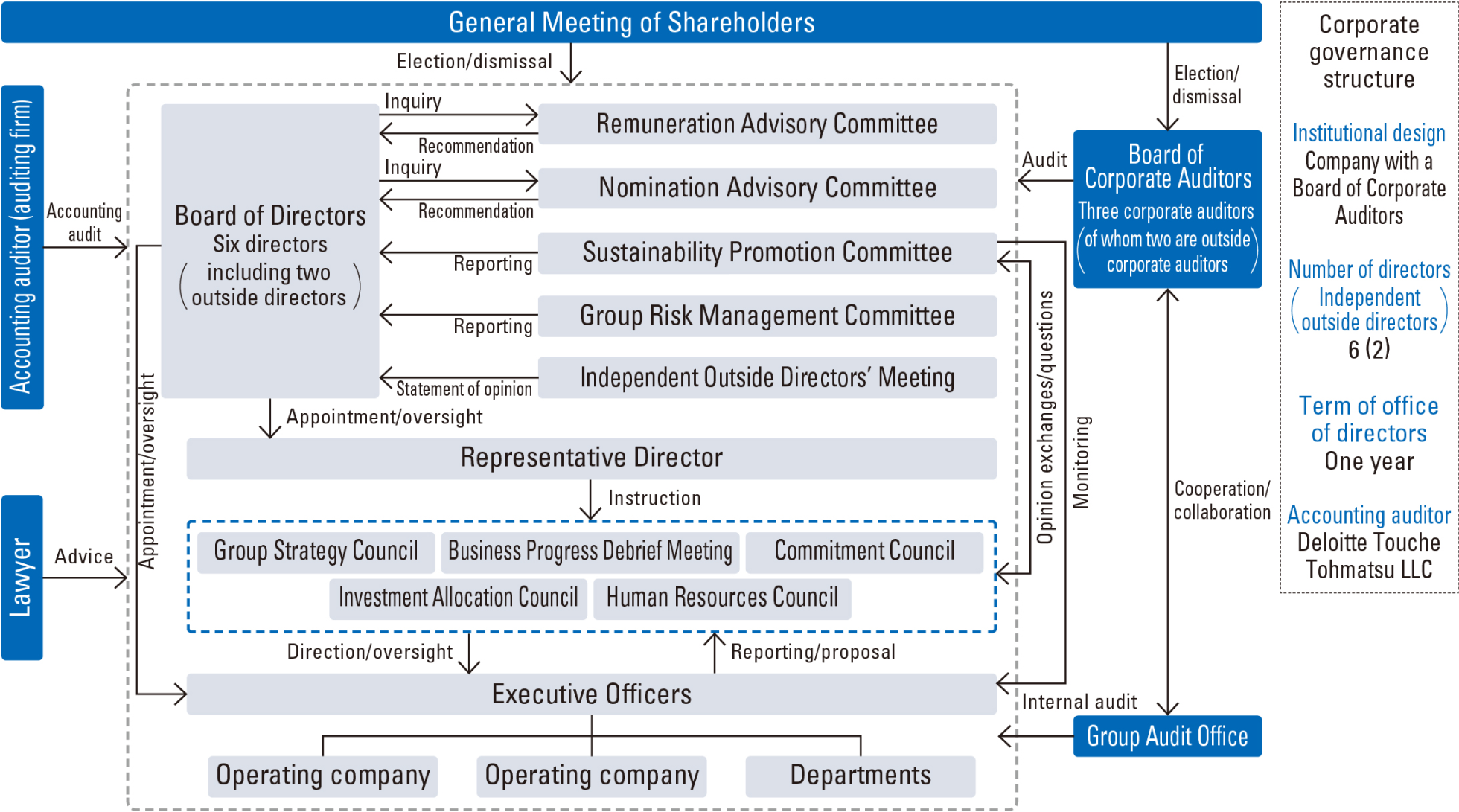

The Board of Directors is composed of individuals with expertise and considerable experience in the Group's industry. This includes general management, sales, financial accounting, marketing, and other specialties, giving maximum consideration to the perspective of diversity and ensuring that the Board suits the unique business characteristics of the Company. The Board of Corporate Auditors consists of people with knowledge of finance, accounting, and legal matters, including those with management experience, certified public accountants, and attorneys. The Board of Directors will further promote diversity and work to increase the proportion of female directors.

In addition, we have introduced an executive officer system, which separates management and execution, thereby accelerating decision-making at each of the Group's operating companies. Important matters are intensively discussed and examined by our directors and executive officers at Group Strategy Council meetings, Business Progress Debrief Meetings, Commitment Council meetings, and on other occasions.

The institutional design of each Group company is based on the premise of not having a Board of Directors, and flexible decision-making is carried out by the director or the executive officer in charge.

Corporate Governance Structure Chart

Remuneration Advisory Committee

The role of the Remuneration Advisory Committee is to deliberate on the determination of remuneration and related matters for directors and executive officers, as well as on the details specific to each individual, and report to the Board of Directors, with the aim of strengthening the independence and objectivity of the functions as well as the accountability of the Board of Directors related to directors' remuneration and other matters. The Committee shall consist of three or more directors elected by resolution of the Board of Directors, and a majority of the members of the Committee shall be outside directors. In addition, the chairperson shall be elected from among the independent outside directors. Specific responsibilities include activities to ensure objectivity in the deliberation of individual details of remuneration for directors and executive officers by viewing them from a neutral perspective based on key management indicators. The Committee also confirms the suitability of each executive officer's rating and the appropriateness of their workload for their respective areas of work.

Nomination Advisory Committee

The Nomination Advisory Committee was established on March 1, 2021, by gaining independence from the Executive Remuneration Advisory Committee, which had previously been an advisory body on remuneration and nomination matters. The role of the Committee is to report to the Board of Directors on director candidates it has selected and the types of individuals we expect to see in our directors, with the aim of strengthening the independence and objectivity of the functions as well as the accountability of the Board of Directors related to nomination of the representative director and directors. The Committee shall consist of three or more directors or corporate auditors elected by resolution of the Board of Directors, and a majority of the members of the Committee shall be outside directors and corporate auditors. In addition, a representative director serves as the chairperson.

Commitment Council

The Council reports on the annual status of business, presents the management plan for the next fiscal year to the directors and executive officers, and commits to the president the numerical targets to be achieved by the subsidiaries or the general managers of each department and division.

Group Strategy Council

The Council discusses and examines matters of importance to the Group as a whole, such as the implementation policies and plans related to the overall management of the Group, based on the basic Group management policy established by the Board of Directors.

Business Progress Debrief Meeting

The Meeting reports and shares the business progress of each subsidiary with the directors and executive officers on a semi-annual basis, thereby improving the management status and reviewing the strategic challenges of subsidiaries as needed and in a timely manner.

Corporate Governance Structure

| Institutional design | Company with a Board of Corporate Auditors |

|---|---|

| Number of directors (of which, independent outside directors) |

6 (2) |

| Term of office of directors | One year |

| Accounting auditor | Deloitte Touche Tohmatsu LLC |

Matters related to corporate auditors

| Establishment of the Board of Corporate Auditors | Established |

|---|---|

| Number of corporate auditors stipulated in the Articles of Incorporation | 5 |

| Number of corporate auditors | 3 |

Cooperation among corporate auditors, the accounting auditor, and internal audit divisions

| Appointment of outside corporate auditors | Appointed |

|---|---|

| Number of outside corporate auditors | 2 |

| Number of outside corporate auditors designated as independent corporate auditors | 2 |