Corporate Governance Functional Effectiveness

Assessment of Effectiveness of the Board of Directors

We perform self-assessments and analyses of the effectiveness of the Board of Directors with the aim of improving the functioning of the Board and, ultimately, enhancing corporate value. Since 2017, we have analyzed and evaluated the Board of Directors once a year at the end of the business period. Moreover, approximately once every three years, we conduct a survey with the advice of an external organization.Going forward, we will improve the quality of the various deliberations at the Board of Directors' meetings to strengthen corporate governance and to consistently enhance corporate value.

1. Evaluation Method and Process

| Method of implementation | Self-evaluation based on questionnaire created by our company |

|---|---|

| Time of implementation | February 26, 2025 through March 7, 2025 |

| Period covered | Board of Directors meetings held between March 2024 and February 2025 |

| The subject of evaluation | Six directors (including two outside directors) and four corporate auditors (including two outside corporate auditors) |

| Question items | (1) Nature and composition of the Board of Directors (2) Operation of the Board of Directors and its discussions (3) Board of Directors' monitoring function (4) Performance of internal and outside directors (5) Support structure and training for directors and corporate auditors (6) Dialogue with shareholders and other stakeholders (7) Initiatives undertaken by the subjects (8) Operation of the Nomination Advisory Committee and the Remuneration Advisory Committee (9) General overview |

Based on the responses to the survey, both the current number and proportion of the Company's directors are appropriate for the deliberations by the Board of Directors and diversity is also assured. We believe that the expertise, experience, and skills of the outside directors are also fully assured.

In addition, in order to ensure the vitality and effectiveness of the deliberations by the Board of Directors, we regularly provide opportunities to provide and share information to outside directors and outside corporate auditors, and we fully ensure cooperation between the internal audit division and directors and corporate auditors, as well as mutual cooperation among independent outside directors and outside corporate auditors. Furthermore, Independent Outside Directors' Meetings consisting of two outside directors and two outside corporate auditors (and chaired by an outside director) are held on a quarterly basis to exchange views on an ongoing basis on matters such as the Company's corporate governance, including the nature of the Board of Directors.

Based on the foregoing, the effectiveness of the Board of Directors of the Company has been determined to be assured. The Board of Directors will further promote diversity and work to increase the proportion of female directors.

2. Responding to Issues Relating to Board Effectiveness in the Previous Period

The previous assessment of effectiveness suggested the need to share sustainability issues within the Company and dialogues with institutional investors. Based on these evaluation results, the Company has established opportunities for sharing information on and discussing sustainability and reporting, including IR reporting, in meeting bodies attended by directors, such as Board of Directors' meetings.

3. Responding to Issues Relating to Board Effectiveness in the Current Period

The most recent assessment of effectiveness suggested the need for further discussion on the allocation of management resources such as investments in human capital and intellectual property, and matters related to the Company's business portfolio, in addition to the need for more active discussions on further enhancing the function of the Board of Directors.

Going forward, in order to ensure the effectiveness of the Board of Directors, the Company will continue to provide information to outside directors and outside corporate auditors and hold discussions, strengthen coordination with business execution as well as cooperation with corporate auditors, thereby improving the quality of the various deliberations at the Board of Directors' meetings to strengthen corporate governance and to consistently enhance corporate value.

Remuneration, etc. of Directors and Corporate Auditors

Remuneration, etc. for directors and corporate auditors consists of and is paid in the form of fixed, performance-linked, and stock-based remuneration, based on the following points to ensure a sound system design conducive to sustainable growth.

- The system must promote sustainable, medium- and long-term improvements in corporate value.

- The system must reflect short-term performance and strongly motivate achievement.

- The system and amount of money paid must be sufficient to attract and retain talented personnel.

- The system must be transparent, fair, and reasonable to stakeholders, and it must be established through appropriate processes to ensure this.

The level of remuneration for directors and corporate auditors, as well as fixed, performance-linked, and stock-based remuneration, will be determined with reference to the level of remuneration for directors and corporate auditors at listed companies of similar size as the Company in terms of market capitalization and sales and profit levels of the previous fiscal year, etc., while considering the various fundamentals of the Company's business and management environment. The basic timing for revision of fixed, performance-linked, and stock-based remuneration is May, but remuneration is not necessarily revised every year.

Generally, the composition of executive officers' remuneration is as follows.

| Composition | Fixed remuneration | Performance-linked remuneration | Stock-based remuneration |

|---|---|---|---|

| Senior directors | 60-70% | 15-20% | 15-20% |

| Directors | 80% | 10% | 10% |

The Company's stock-based remuneration plan provides for the issuance of stock as remuneration to directors, excluding outside directors, with transfer restricted until retirement from their positions. Our objective with the introduction of this system is to encourage our directors to further share value with our shareholders, reinforce their medium- to long-term commitment, and increase their intention to contribute to enhancing corporate value. For eligible directors, all monetary claims paid by the Company in accordance with this system will be transferred as property contributed in kind, and common shares of company stock will be issued or disposed of. The total amount of monetary claims to be paid to directors will be no more than 30 million yen per year (excluding the portion of employee salary for directors who serve concurrently as employees), and the timing and allocation of the payment will be determined by the Board of Directors.

Individual remuneration for directors is determined by the Remuneration Advisory Committee —consisting mainly of outside directors—based on the individual director's position, responsibilities, and performance during the applicable fiscal year. The Committee then submits its recommendations to the Board of Directors, which makes decisions on them.

Individual remuneration for corporate auditors is determined through discussions among the corporate auditors.

Succession Plan Concept

To perpetuate the Group's brand—with a history of more than 120 years—management must have a deep understanding of the Company's philosophy and put it into practice. We believe that developing next-generation management is the most significant responsibility of the current management team. As such, in March 2021, we established the Nomination Advisory Committee, chaired by the Representative Director and President with outside directors and outside corporate auditors as members.

With the objective of shaping governance in accordance with our company's unique value creation story toward sustainable future growth, we endeavor to clearly define requirements for management personnel, ensure transparency in the selection process, and share information on candidates and their skills and development issues through the Committee's operation.

This has strengthened the function of the Board of Directors in nominating the representative director and directors, while ensuring their independence, objectivity, and accountability.

With regard to the development of candidates for next-generation management brought to our attention by the Nomination Advisory Committee, we will provide growth opportunities through personnel reassignment, training, etc., and systematically promote their development. Moreover, we are revising our personnel and evaluation systems to expand the pool of talented young management candidates.

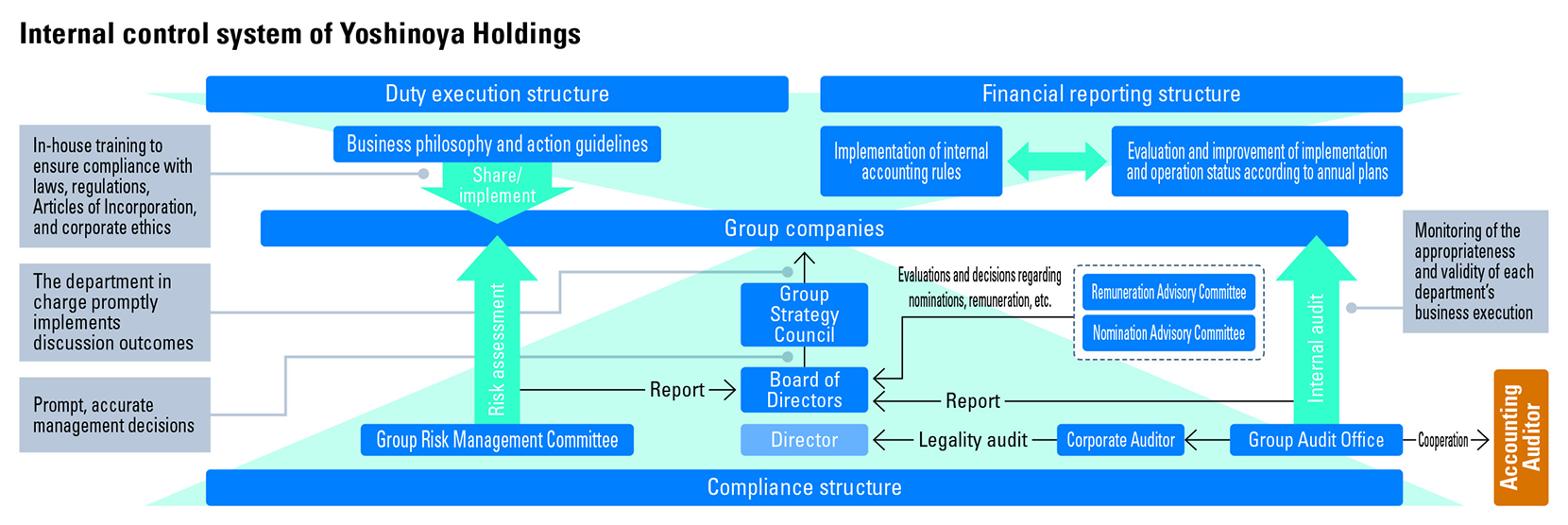

Internal Control System

We are striving to strengthen and enhance the internal control system throughout the Group from the perspective of ensuring management transparency and efficiency, legal and regulatory compliance in our corporate activities, and appropriate risk management.

As a system to ensure that the execution of duties by directors and employees of the Group is in compliance with applicable laws, regulations, and the Articles of Incorporation, our business philosophy and action guidelines are shared and practiced at each Group company. Furthermore, internal training is conducted to ensure compliance with laws, regulations, and the Articles of Incorporation and to ensure thorough adherence to corporate ethics. Concerning financial reporting, we have established internal accounting rules to properly prepare financial reports in accordance with laws and regulations and evaluate and improve their implementation and operation status in line with annual plans. The Group Risk Management Committee is responsible for evaluating the status of compliance and risk management in the Group and reports to the Board of Directors.

As part of a system for the efficient execution of duties by directors, in addition to monthly meetings, the Board of Directors meets as necessary, and meetings including those of the Group Strategy Council are also held with the purpose of supplementing prompt and accurate management decisions. The departments in charge then promptly implement the decisions resulting from discussions at these meetings. The Group Audit Office then conducts internal audits of the Company or each Group company in accordance with the audit plan approved by the Board of Directors. The results of audits conducted by the Group Audit Office are reported to the president, the executive director in charge of the relevant division, and the corporate auditors at the Audit Report Meeting. Moreover, our directors and executive officers concurrently serve as directors and corporate auditors of each Group company. Through this and other means, they keep abreast of the decision-making and business operations of the subsidiaries, thereby ensuring appropriate supervision.

Corporate auditors audit the legality of operational execution by directors in accordance with the audit plan formulated by the Board of Corporate Auditors. In addition, corporate auditors attend meetings of the Board of Directors and other important meetings to receive reports on important matters. In conducting audits, corporate auditors exchange opinions and cooperate with the Group Audit Office and the accounting auditor.

Moreover, the Company has the Remuneration Advisory Committee and the Nomination Advisory Committee as voluntarily established advisory bodies to the Board of Directors. The supervisory function has been strengthened by further clarifying and objectifying the evaluation and decision-making process regarding the nomination, remuneration, and other matters concerning directors, leading to further improvement of the internal control system as well.